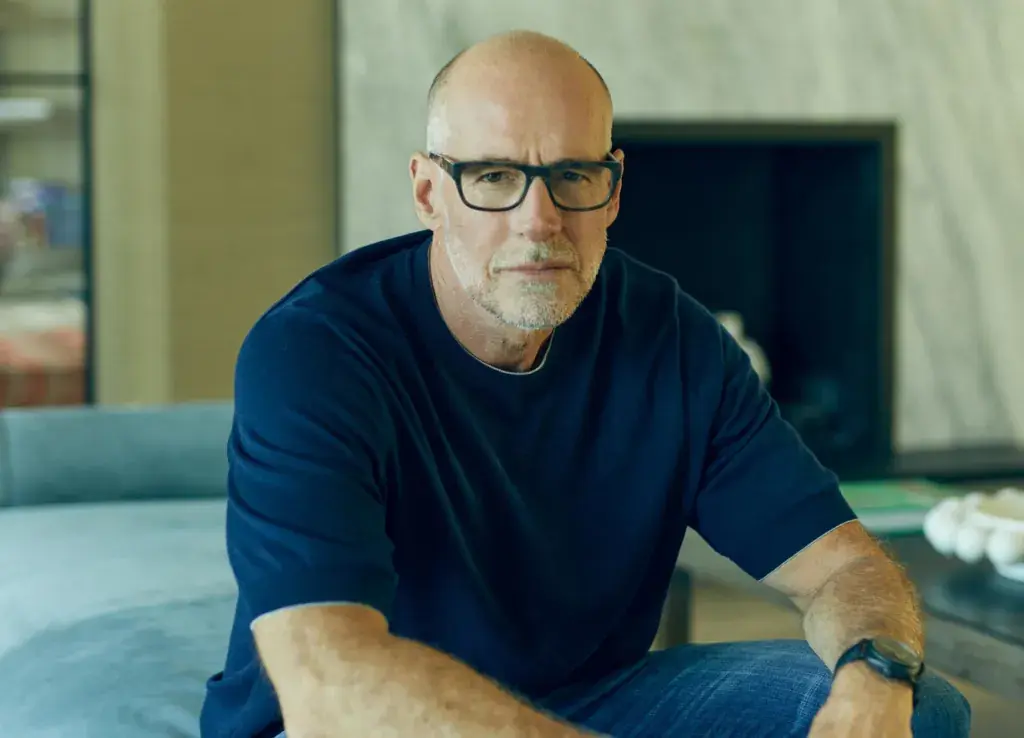

What Are You Willing to Sacrifice to be Wealthy? w/ Scott Galloway

Explore Scott Galloway's journey to $100M on Hampton's MoneyWise podcast with Sam Parr. Learn about financial sacrifice, entrepreneurship, diversification, and giving back from this serial entrepreneur and professor.

On his road to $100M, Scott Galloway seems to have lived a hundred lives.

Scott didn’t grow up with money. On the pod, he recalls the stress of losing a $33 jacket as a kid. Recently, he lost $5M on a single investment and only let it ruin an hour of his day. How does Galloway spend, prioritize, invest, and— ultimately— lead a fulfilling life and give back?

Listen below to find out!

Spoiler alert: Scott & Sam discuss sacrifice, luck, investing, and something Galloway thinks every entrepreneur should know about: “the spoon.”

HERE'S MY TAKE

Scott Galloway grew up in what he calls the "upper lower middle class." His mother was a secretary, and Scott estimates their household income to be between $40,000-$50,000. He was motivated from an early age to work hard and was willing to make significant sacrifices for financial stability.

Scott’s Financial Ride

- At 26, Scott sold his company for $33M

- He experienced significant losses during the dot-com bust and the 2008 financial crisis. In 2008, he went from being worth about $20M to -$3M in about 11 weeks…

- Scott founded L2, his last company, which was sold for $160M

- Scott mentioned his ‘number’ (lifetime financial target) being $100M. He’s hit that now, and says he’s “done.” He’s still doing a ton of writing, speaking, and podcasting, and on the subject of work said: “I work hard because I like to work. I'm really passionate about the topics I'm talking about. I talk a lot about the struggles facing young people, specifically young men. I love doing podcasting. I love talking about the economy and things that are going well and not going well. So I can't imagine having more fun than I'm having right now. This is pretty much 90% want.”

The Price of Success: Sacrifice and Balance

On the value and necessity of sacrifice for wealth, Galloway said: "Young people talk about wanting balance in their lives and it's like, okay, well then you don't want to be rich."

He half-joked that his success in his 20s and 30s cost him his hair and his first marriage, but suggested balance could be achieved later in life, saying “You can have it all. You just can’t have it all at once.”

The Spoon: Galloway's Raw Advice for Entrepreneurs

Most memorably, Scott shared: "If you want to be an entrepreneur, if you really want to, like, make a shit ton of money more than your friends... There's one thing I call it the spoon, and that is you need to get out a big spoon and be willing to eat shit."

Galloway credits being able to endure rejection with a lot of his success and states that "99% of people are not willing to [face rejection]. They aren't willing to risk public humiliation."

The Importance of Diversification

Galloway discussed diversification as critical to success and stability, citing failure to diversify as a main contributor to his early financial pitfalls.

Galloway advised diversifying early, even if it means potentially missing out on some upside. This strategy protects against catastrophic losses and helps maintain mental health & overall life stability during market downturns.

Spending and Giving

Galloway was transparent about his spending habits, and noted that it’s easier than one might think to spend $300-400k per month, especially living in NYC and London. He gives a full breakdown of his spending in the episode!

On giving, Galloway said: “giving away money feels really awesome. I'm not trying to virtue signal. It's something I love doing. It makes me feel masculine. It makes me feel like a good citizen. I love investing or giving money to things I'm passionate about. I've given away I think about 20 million bucks in the last five, six years. Anything above my number now I either spend [or give away].”

OTHER KEY QUOTES

- "You think Roger Federer never talks about tennis? If you want to be good about money, you need to talk to your friends about money."

- "Diversification is your Kevlar… "Anyone who is fortunate enough to aggregate any level of wealth should start diversifying immediately."

- "If you want to be able to score above your weight class professionally or personally, you've got to be able to take uncomfortable risks and endure rejection."

- "The vast majority of people are only comfortable signing the backs of checks, not the fronts."

LINKS YOU MIGHT LIKE

- Moneywise: The Realities of Retiring Early

WE'VE GOT OTHER BADASS EPISODES:

- Moneywise Ep. #13 It’s Easy to Spend but Hard to Spend Well

- Moneywise Ep. # 9 Transparent Personal Finances of 100 Millionaires

Personally, I find being the CEO of a startup to be downright exhilarating. But, as I'm sure you well know, it can also be a bit lonely and stressful at times, too.

Because, let's be honest, if you're the kind of person with the guts to actually launch and run a startup, then you can bet everyone will always be asking you a thousand questions, expecting you to have all the right answers -- all the time.

And that's okay! Navigating this kind of pressure is the job.

But what about all the difficult questions that you have as you reach each new level of growth and success? For tax questions, you have an accountant. For legal, your attorney. And for tech. your dev team.

This is where Hampton comes in.

Hampton's a private and highly vetted network for high-growth founders and CEOs.