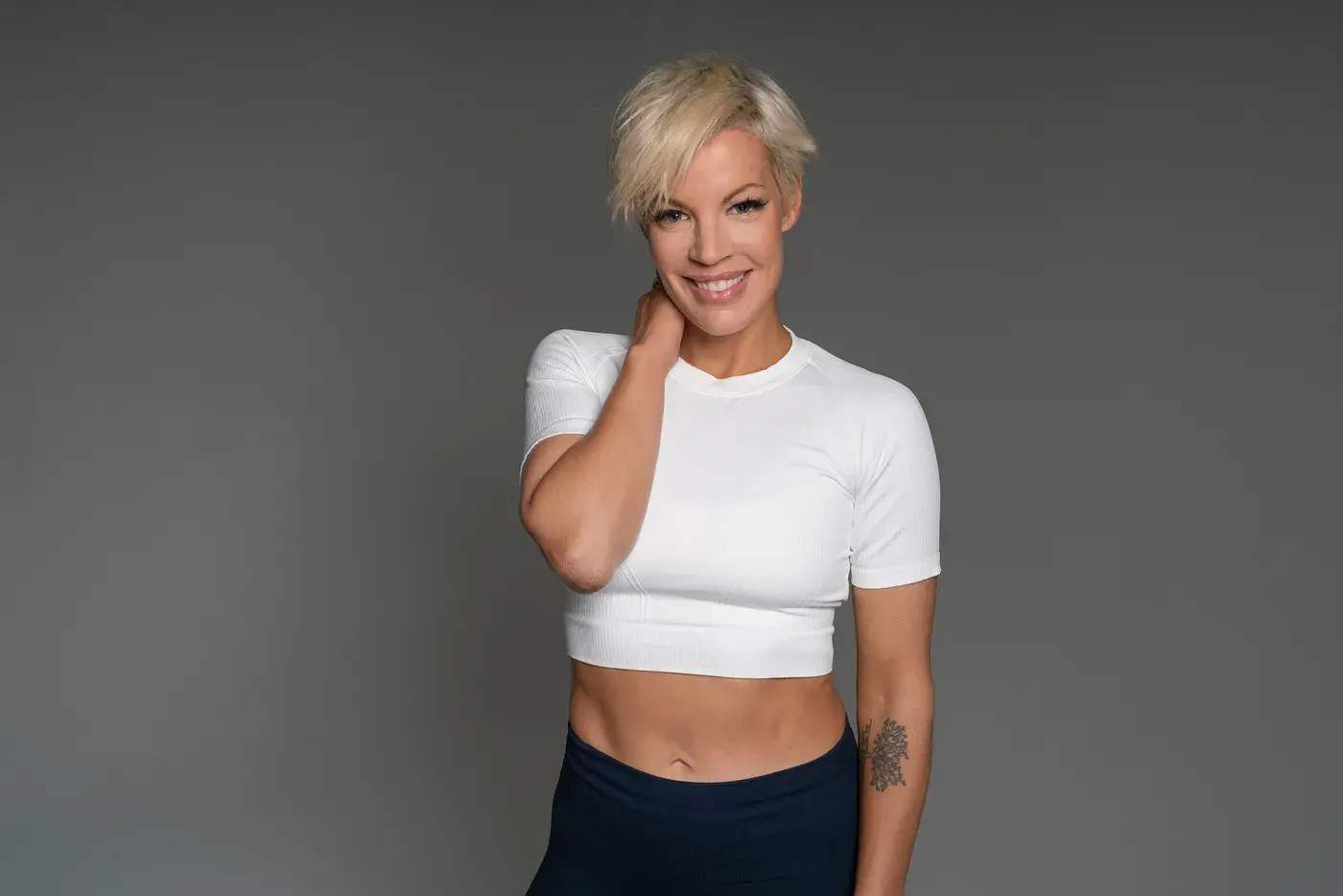

From $175k to over $100M: A Journey of All-In Bets and Astonishing Success w/ Anne Mahlum

Explore Anne Mahlum's journey from nonprofit worker to $100M+ entrepreneur on Hampton's MoneyWise podcast with Sam Parr. Learn about strategic risk-taking, gradual wealth building, and evolving spending habits from this self-made fitness mogul and confident investor.

Confidence is key, but confidence is earned. And Anne Mahlum has earned hers.

She has dedicated her life to self-improvement and continuous learning. Because of that, combined with her insanely positive attitude, she's built a networth of well over $100M.

Her confidence in herself is evident. In fact, she once turned down a significant investment into her start-up in favor of using her entire personal net worth instead.

Listen to the episode on Apple Podcasts or Spotify.

Here's My Take

Anne's story is a masterclass in strategic risk-taking and self-belief. Her journey from a small-town upbringing to building a $100M+ net worth shows that with the right mindset, anything is possible. What's particularly inspiring is how she transformed childhood insecurities into adult success.

Anne's Financial Journey

Anne's drive started early. "I was trying desperately to get [my parents] to love me more than they loved my siblings," she recalls of her childhood. This drive led her to:

- Start with $175,000 in savings from nonprofit work

- Invest her entire net worth into Solid Core fitness company

- Become profitable within the first month

- Scale to 25 studios in 4 years without outside investment

When offered a $75,000 investment for 30% equity, Anne made a bold decision: "I said, if I take this money, all I'm doing is saying I doubt myself. I just knew I had to go all in and if I wasn't comfortable going all in, I shouldn't do it at all."

This all-in approach paid off:

- First major liquidity: $6M from private equity deal in 2017

- Second deal: Another $9M off the table

- Built Solid Core to over 100 studios before selling

The Power of Gradual Wealth Building

Anne's approach to wealth is both strategic and introspective. "I needed to get comfortable with wealth," she explains, "and I knew if I continued to push that off and all of a sudden got this massive check, I sort of felt like that was going to be complicated for me, for my friends, my family."

Her strategy included:

- Taking money off the table in stages during private equity deals

- Investing in a diverse portfolio: public equities, private investments, real estate

- Focusing on getting comfortable with wealth gradually

- Educating herself extensively on investing and wealth management

Evolving Spending Habits

Anne's journey from frugality to strategic spending is a testament to her growth mindset. Initially very conservative, she now embraces a more liberal approach:

- Spends $200,000-$300,000 per month

- Purchased a $12M primary residence, $14M condo investment

- Focuses on appreciating assets and experiences (e.g., $100K+ trip to Wimbledon)

- Gifts money to family and employees

- Believes in the "Die with Zero" philosophy

On spending, Anne doesn't mince words: "I hate when people say, don't spend the principal. I'm like, when you have the amount of money that I that's just stupid advice."

Other Key Quotes

- "You think businesses need to make their employees happy, their customers happy, and their shareholders happy. And I think one of the mistakes a lot of people make is they don't really make the shareholder happy, and that's themselves. I mean, ultimately, you're the one doing all the work. And I've always felt that you should get paid well."

- "If you aren't willing to invest any time with podcasts or reading and learning about money like you deserve to be broke, it's fully, publicly available for anybody to educate themselves on. And I was completely broke and also knew nothing about money when I was 27, 28. Like people think, oh, I don't know anything. I'm like, well, you can still learn just because you don't know it now."

Links You Might Like

- Anne's Instagram

- Rich Dad Poor Dad by Robert T. Kiyosaki

- Die with Zero: Getting All You Can from Your Money and Your Life by Bill Perkins

-

Money Master the Game: 7 Simple Steps to Financial Freedom by Tony Robbins

We've Got Other Bad Ass Episodes

- Moneywise Ep. #13 It’s Easy to Spend but Hard to Spend Well

- Moneywise Ep. #11 What Are You Willing to Sacrifice to be Wealthy?

Personally, I find being the CEO of a startup to be downright exhilarating. But, as I'm sure you well know, it can also be a bit lonely and stressful at times, too.

Because, let's be honest, if you're the kind of person with the guts to actually launch and run a startup, then you can bet everyone will always be asking you a thousand questions, expecting you to have all the right answers -- all the time.

And that's okay! Navigating this kind of pressure is the job.

But what about all the difficult questions that you have as you reach each new level of growth and success? For tax questions, you have an accountant. For legal, your attorney. And for tech. your dev team.

This is where Hampton comes in.

Hampton's a private and highly vetted network for high-growth founders and CEOs.