Things I Was Wrong About: B2B SaaS vs Agency Sales Cycles

Jess Chan scaled her agency to 7-figures in year one, and has driven $30m+ for clients. Here, she offers real-talk on a launch that didn't go as-planned.

.png)

We have a saying in Hampton: "Speed to vulnerability."

It means we focus on real-talk; Celebrating the wins, but also giving members a place to share the challenges and setbacks that come with being a founder. It's a big part of our culture, and so we tend to attract people who are both self-aware, and brave enough to open up.

Jess Chan is one of these.

In addition to being incredibly personable (she's a hit at every Hampton event she's attended and hosted), she's one of the most self-aware leaders I've ever met. Her Diary of an Entrepreneur series is proof of that, with daily insights on the ups and downs of leading a successful multi-million dollar company.

When I heard she was planning to extend the concept to a series of long-form pieces exploring "things we get wrong as founders", I had one request (really, I begged her):

"Let us publish the first one!"

In this piece, Jess digs into the launch of Backbone, a new SaaS whose launch turned out different than expected.

The mental exercise she undertakes, reviewing and testing her assumptions, is one every founder will benefit from trying. And her notes on everything from what she feels she missed, to how the team is re-allocating budget and what she'd do differently next time, will save you months of work and tens of thousands in expensive lessons.

Be sure to check her out for more, and share this with a founder you know who may need it. And if you're looking for a place to have more conversations like this, apply to join Hampton today

Enter Jess...

Background

I’ve been running & building Longplay for 4+ years. We’re a retention marketing agency for DTC e-commerce brands. We got our start specializing in email marketing, and have expanded to broader retention strategies since then. We’ve got an incredible team of 25+ that handles most of the day-to-day of the business and I personally only spend a few hours a week on it, mostly in sales.

Last year, we started building Backbone, a B2B SaaS tool targeting DTC brands. The vision & goal is to automate the job of an email marketer. Kind of like what Facebook algorithms did for media buyers since 2015. The idea for Backbone came from all of the systems we’d built to get me out of strategy & client work for Longplay, while keeping the quality and strategic thinking.

All those systems eventually turned into the algorithms behind Backbone.

We launched our beta for Backbone in March and the first 2 months were way more challenging than I thought. I’ve learned a lot about sales, sales cycles, positioning, and product-market fit... and still have so much more to learn.

My Hypothesis: What I’d originally thought when we launched Backbone was that a B2B SaaS tool would have a faster, shorter & simpler sales cycle. I had scaled an agency from zero to 7-figures within the first year, bum tumbling around as a 22-year old knowing nothing about business — so this would be even easier and faster.

I couldn’t have been more wrong.

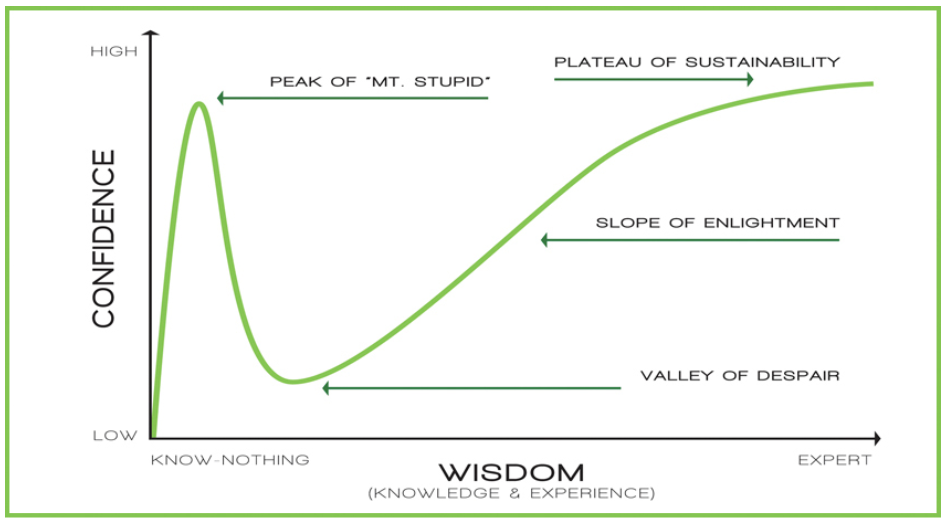

I started on “Mt. Stupid” and have now transitioned into the “Realization” stage (which means there’s still a world of hurt before I even get to the Valley Of Despair.):

This is a blog post about what I’ve learned in that journey & why I was so wrong.

About This Series

This is one of my “Things I Was Wrong About” essays which is a part of my Diary Of An Entrepreneur Series. I wanted to start this series because most of entrepreneurship is trial-and-error and we’re wrong more often than we’re right. But how we learn from our errors (and how quickly we can move through them) is where the opportunity lies.

One of my favorite practices that I picked up on from 4 years in college of theoretical calculus & traumatic mathematical proofs is to reflect back on paths of logic that I thought were rock solid to figure out:

- What’s my hypothesis & did it prove to be true?

- What was the reasoning behind my original hypothesis?

- Was the reasoning incorrect or were there variables that I didn’t account for?

- Were there factors I took as fact that were actually assumptions?

- Were there areas where the logic didn’t hold up that I glossed over? Or deductions I made that weren’t logical?

SIDE NOTE: Even when my hypothesis is proven to be true, it’s still good to run through this & I like to ask myself the question “Is there a scenario where this wouldn’t have worked? How did context play into this working?”

______________________

The Hypothesis

So, to recap, my original hypothesis was:

- It’d be relatively easy to get to $1M within a year

- Backbone’s sales cycle would be at most 1 call (and none with self-serve) with maybe 1 follow-up email

- Initial lead generation to get to the first 50 users would be easy since we had been in the industry for 4+ years and are tapped into the DTC community

- Backbone would let me get out of sales & into marketing

The Reality

- The B2B SaaS sales cycle has way more touch points & is longer than an agency

- Getting from $0 to $1M for SaaS is harder than an agency. But getting from $1M - $10M+ is (I think) easier for SaaS than an agency. And the ceiling for growth is much higher.

- The upside of SaaS isn’t necessarily the speed/ease (and definitely not the cost) of getting it off the ground, but the capacity for scale after that.

- In fact, finding product-market fit is in some ways harder for SaaS & takes longer because you naturally have less face-to-face time with your ideal customers than an agency where you literally talk to them daily/weekly. And it’s way easier to iterate & adjust a service than a product.

- The job of a CEO will always be sales & talking to customers. Especially early on. Which is no fun for an introvert like me.

___________________

The Reasoning

I was thinking the sales cycle for Backbone would be a lot easier & faster, and it’d be easier to get off the ground than Longplay for a few reasons:

- Price: Backbone is a $349/mo product while Longplay’s contract values start at $40K and go up to $150K+. It can’t be harder to sell a $349 product than a 5- or 6-figure contract right?

- Risk & Friction To Purchase: Backbone is a month-to-month product with a 14-day free trial, while Longplay’s services have a 6-month minimum. So agency sales is a significantly higher ticket sale & for a longer-term contract which makes it higher risk for the customer.

- Time-To-Value: You can get signed up, onboarded & using Backbone within days (or minutes if you go self-serve) whereas Longplay takes 1.5-2 weeks for all of the sales calls + contract and another 4 weeks for onboarding. So we should be capitalizing more on that impulse need to find a solution.

- Competition: There’s also way more competition with other email marketing agencies for Longplay & potential clients are usually vetting a few agencies so we’re always going head-to-head with competition. Whereas we really don’t have any direct competitors for Backbone - there’s no other software out there that does what it can do (which is why we built it)

- Leads: I also assumed that since I had been pretty plugged into the DTC e-commerce space for 4+ years with a network of old leads, clients, communities, and personal connections that we’d have a jumpstart to lead generation that I didn’t have when I started Longplay.

The assumption was that we’d be able to reach out to my roster of connections, people would book a 30-minute demo call or start a free trial themselves. The challenge would be in ongoing retention and scaling lead generation.

_____________

Why I Was Wrong & What I Missed

I was literally wrong on all fronts AND found multiple other factors I didn’t even account for.

Stage Of Buying Cycle

I didn’t even think of this factor.

When someone is looking for an agency, they’re at a stage in the buying cycle of having an acute pain point and are actively seeking a solution. They’re also very clear on what that solution likely looks like for them (an agency team). They’re looking for immediate relief from any team/service that seems like they could be the solution.

From the beginning, Longplay has grown solely through inbound — word of mouth and direct referrals. I’m talking about no content marketing, SEO, or outbound. And there’s a ton of built-in trust by the time they get us. That’s as warm as a lead gets.

On the flip side, leads for Backbone are pretty lukewarm, if not cold. They book a demo call because they find it interesting and want to have it on their radar. They might not have a serious pain with email marketing — they’re just seeing if it could be better. No one jumps on a discovery call with an agency just because they saw it on Twitter (I don’t think) if they weren’t already at least thinking about needing a solution.

And if they do have an acute pain, they’re probably already looking for an agency or freelancer, and won’t do a 180-degree switch to software as a solution.

So that means a Discovery Call for an agency in the sales cycle is a lot higher impact, with a significantly warmer lead which makes it easier & faster to close.

Competition

Competition isn’t a bad thing. There’s a lot more competition for Longplay as an email marketing agency, but that also means prospects know exactly how we fit into the realm of what they know. We’re an email marketing agency. We don’t need to educate them on what an agency is or what we do — we just need to educate them on what makes us different and better.

Competition gives prospects something to anchor us to & compare us to — which helps them easily understand what we do & how we can help them.

No one is looking for an email strategy automation tool. It can help them... but no one’s looking for it.

This gap in the market is both a massive opportunity and a massive challenge. We don’t have competition so we don’t need to compare ourselves to other software. We need to establish ourselves as a viable alternative to the traditional suite of solutions they’ve always known to solve their email marketing problems: hiring a freelancer, an in-house email marketer, or an agency.

The lack of competition (aka. blue ocean) makes it harder to get off the ground but easier to scale once we’ve established ourselves.

Risk, Cost & Friction To Purchase

Wow, this one had me banging my head against the wall. My original model of risk included 3 variables: price, commitment, and trial.

| Variable |

Backbone |

Longplay |

| Price |

$349/mo |

$7,000+ per month |

| Commitment |

month-to-month |

6 month minimum |

| Trial |

14 days |

None |

Backbone was a lower risk on every factor compared to Longplay — so there should be a significantly lower friction to purchase and speed to conversion.

But I had missed one critical variable: time investment.

There’s a hidden cost of time investment for B2B SaaS — and that scales exponentially if you’re targeting businesses with a team. It’s the cost of having to spend time figuring out whether the tool would work for them, who on their team would use it, the learning curve of adopting the tool, how to introduce it to the individuals who would use it, and how to integrate it into their workflow.

This is the factor that’s killing us the most in extending the sales cycle for Backbone. Almost every demo call we’ve had is met with incredibly positive feedback & excitement. We’ve literally heard things like “Wow, this is the future of email” and (I kid you not) “You’re doing the lord’s work — how has no one thought of this?”. So I’m pretty confident we’re innovating & there’s product-market fit...in the long term. But innovation & vision isn’t enough to close a deal right now.

So Backbone is stuck in this phase in the buying cycle of “wow this is really interesting, I see its potential & I really want to use it” but actually starting the trial and adopting the tool is always on the back burner because they need to carve out time & energy to do so... and it’s never a priority when there are always active crises & immediate problems to solve in an e-commerce company.

On the flip side, an agency service solution has a much more defined & accepted time investment cost. They expect to need onboarding and to send us information. And with Longplay, once clients sign the partnership agreement, our team really manages them step-by-step and it’s a truly done-for-you solution.

Lead Generation & Distribution Channels

To be honest, I’m kind of punching myself for this one because it’s painfully obvious.

I thought we’d have a wealth of leads to get to the first 50 users because of being in the DTC e-commerce industry for a while and all of the brands we’d served, leads we’d walked to, communities I was a part of, and my personal connections.

But what it comes down to is that Longplay has always worked with 8-figure brands and we literally built Backbone because smaller 6-figure and low 7-figure brands often can’t afford an agency, but need email to scale. That was the gap in the market we identified.

And so, while we’re plugged into the DTC e-commerce industry, it has primarily been 8 and 9-figure brands which isn’t our target market for Backbone. And we actually don’t have direct access to distribution channels where 6-figure founders and CEOs spend time.

_____________

What We’re Doing About It

Entrepreneurship is just trial & error, so what’s our next trial?

Based on all of that, here are the strategic changes I’m making in our marketing, positioning, sales & business planning:

Business Planning & Resource Allocation

Since we’re bootstrapping Backbone with Longplay, we keep our cash flow planning TIGHT. And since Backbone is taking longer to generate significant revenue than I thought, we’re buying time by re-investing more in sales & growth for Longplay knowing that it’ll take Backbone longer to be self-sufficient than originally expected.

We’re taking this cash from budget that was originally allocated to helping scale Backbone’s marketing systems (such as outsourcing more content production, social media management etc) and putting this back onto my plate personally. The other upside of this is that there’s a lot more work to be done in Backbone’s positioning and lead generation strategy which will be way more effective with me getting my hands dirty in these areas for at least another 6-12 months.

Lead Generation & Funnel Marketing

We’re heavily investing (mostly time) in creating lead magnets and content for our target demo.

Since we’re targeting 6 and low 7-figure DTC brands, they often have more time than money and building trust by being a thought leader and providing resources will get them in the door and warmer to buy.

This is essentially shifting our marketing strategy to a longer content funnel approach to add value to leads at each stage of the sales cycle AND creating paid content (like our DTC Flow Foundations Guide) and productized services to monetize them at each stage to (hopefully) generate revenue at a faster clip than the sales cycle length.

Expansion Of Products & Services

We’re shifting to a solution-focused mindset for product & services development. Everything we create & offer needs to solve for our target demo’s current visceral pain point. This means building a product/service strategy where Longplay and Backbone are much more integrated to act as a full solution.

The number of scenarios that makes Backbone a perfect solution is small. The number of scenarios that makes Longplay a perfect solution is slightly larger. But the number of scenarios where Backbone and Longplay (product + services) together makes a perfect solution is huge.

Instead of keeping them as two totally separate companies, Longplay can offer productized services to monetize Backbone leads, act as a lead magnet, and be upsold along with Backbone to provide a full solution to their most visceral pain points.

Positioning

Part of this integration of the two companies externally also allows us to leverage Longplay’s authority & credibility in the industry to Backbone rather than starting from scratch. So we’re going to use Longplay’s history & track record more in the positioning of Backbone.

We’re also revamping Backbone’s positioning to be much more solution-oriented rather than tool-oriented. To be honest, this one I’m kind of punching myself for as a marketer because this is an embarrassing reminder of benefits > features, and solution > product always works best in any marketing strategy.

We already started asking discovery questions on Backbone demo calls to understand their current state of email & where their pain points are, so we’re going back to watch all of these calls along with Longplay’s discovery calls to fuel our website copy, positioning, and the content we create.

_____________

What I Would’ve Done Differently

Now, if I knew what I know now, what would I have done differently from the beginning?

We had done a ton of user interviews, user testing, mockup demo calls and such, so I think we followed the MVP development process well from a product-market fit standpoint.

But I would’ve started building out our lead generation strategies to target 6 and low 7-figure DTC e-commerce brands before we were even close to starting development for Backbone. I would’ve started by creating productized services with Longplay, investing in SEO then creating content, lead magnets & paid courses — knowing it would all build up to a proper wait list for Backbone and generate revenue for Longplay in the meantime.

________

SIDE NOTE: Diary Of An Entrepreneur Thoughts

As a final ramble more on the emotional entrepreneurial journey of learning all this — it can get tough. I felt like a failure after each of those insights. I felt shame in the thoughts that “I’m supposed to be a marketer, I should’ve seen this” — especially everything to do with positioning and lead generation.

I also realize that this is the process of building a company. The nature of entrepreneurship is trial-and-error, and to be wrong more often than you’re right. Most of building a business is just having a hypothesis, testing it, and adjusting.

But I think the art is to recognize what are hypotheses & assumptions rather than fact. Blindspots, over-leveraging, and massive risks happen when we mistake assumptions & hypotheses for fact so we go all in thinking an idea is bulletproof.

And lastly, how quickly we’re able to recognize & admit when we’re wrong, and pivot is ultimately the key to long-term success.

For More From Jess...

- Follow her on Twitter

- Subscribe to her Blog

- Or check out Longplay and Backbone

Personally, I find being the CEO of a startup to be downright exhilarating. But, as I'm sure you well know, it can also be a bit lonely and stressful at times, too.

Because, let's be honest, if you're the kind of person with the guts to actually launch and run a startup, then you can bet everyone will always be asking you a thousand questions, expecting you to have all the right answers -- all the time.

And that's okay! Navigating this kind of pressure is the job.

But what about all the difficult questions that you have as you reach each new level of growth and success? For tax questions, you have an accountant. For legal, your attorney. And for tech. your dev team.

This is where Hampton comes in.

Hampton's a private and highly vetted network for high-growth founders and CEOs.

.png?width=352&name=Blog%20Featured%20Image%20(14).png)

-1.png?width=352&name=Blog%20Featured%20Image%20(17)-1.png)

-1.png?width=352&name=Blog%20Featured%20Image%20(37)-1.png)