Scott Galloway's Net Worth is $100M. His Goal? Just Spend It or Give It Away.

On Moneywise, we don't do secrets—Scott Galloway shares the full breakdown of his wealth, from his $160M exit to how he's spending every dollar.

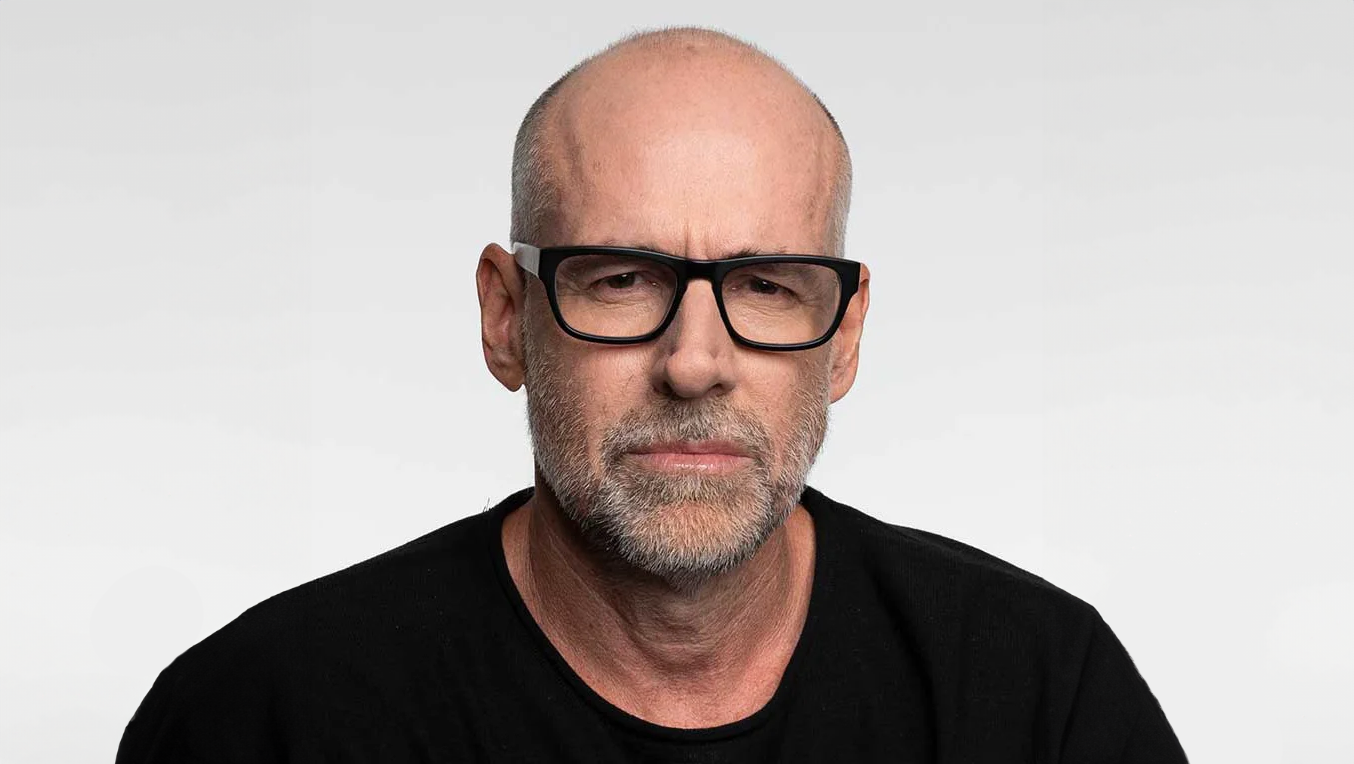

We spoke to Scott Galloway in this week's episode of Moneywise.

Scott Galloway is a professor, bestselling author, podcast host, and entrepreneur who has started and sold multiple companies for hundreds of millions. He grew up in what he calls the "upper lower middle class" and now lives a life of luxury after hitting his personal wealth target.

Like all Moneywise episodes, Scott breaks down his net worth, income, portfolio, and monthly expenses and then I, your humble host, pick it all apart.

We also went deep on: his path from financial insecurity to wealth, why diversification saved him after multiple financial disasters, and his philosophy about wealth hoarding in America.

Below you'll find my summary of the episode along with the entire transcript.

And by the way...this podcast, the concept of it came from Hampton, which is a company I founded. Hampton is a community of business owners who meet monthly in small groups to help each other grow their companies. Hampton members range from founders of companies with a couple million in revenue up to publicly traded companies with thousands of employees. I get to see all these private conversations about money, and that's what inspired this podcast. If you have a business doing over $3M in revenue, you might be a good fit. Check us out. New Moneywise episodes come out weekly.

Now, below are the notes and the full transcript.

The Numbers

- Net Worth: ~$100 million (his self-defined target or "number")

- First Sale: Sold brand strategy firm "Profit" for $33 million at age 26 (owned 20-30%)

- Recent Sale: Sold L2 for $160 million

- Monthly Expenses:

- $100,000 on mortgages and real estate (four homes)

- $50,000-100,000 on living expenses

- $100,000 on travel

- $100,000-125,000 on fractional plane ownership

- Total: $350,000-425,000 per month

- Charitable Giving: ~$20 million given away in the last 5-6 years

- Investments: Maintains about 30 different investments (no more than 3% of net worth in any single investment)

- Recent Loss: Recently lost $5 million on a healthcare AI investment (full write-off)

From Struggling to Wealthy: The Psychological Impact of Money

Scott's relationship with money was shaped by growing up with financial insecurity. "My mom was a secretary. I don't think we ever had a household income above 40 or 50 grand," he shares. This early struggle created what he calls "a ghost following you around kind of whispering in your ears all the time, you're not worthy."

This experience intensified when his mother became ill. "As the man of the house, quote unquote, it was upsetting and even humiliating not to be able to take care of her," he recalls. This period created a powerful motivation: "At a very early age, I thought, no one makes a decision to be wealthy, but I decided I was going to try very, very hard and that I was willing to make really significant sacrifices to try and get there because I wanted out. I didn't want to go back to that place of financial insecurity."

Scott attributes his success to a combination of talent, hard work, and the opportunities provided by public education. "I believe I'm here with you because of the generosity of California taxpayers and the vision of the regents of the University of California who loved unremarkable kids."

The Harsh Reality: Success Requires Sacrifice

One of Scott's most candid revelations addresses the myth of balance. "Young people talk about wanting balance in their lives and it's like, okay, well then you don't want to be rich," he states bluntly.

He divides his life into two distinct periods: "I've had two periods in my life, one where I had a lot of balance, good relationships, great shape, hobbies, and periods where I had no balance. Was working all the fucking time. Was incredibly anxious. My relationships were suffering." The key difference? "In the former, my net worth was increasing. In the latter, it was going down."

Scott doesn't sugarcoat the trade-offs: "I often joke that my success in my 20s and 30s cost me my hair and my first marriage, and that it was worth it. I have a lot of balance now because I didn't have much when I was young, so you can have it all. You just can't have it all at once."

Diversification is Your Kevlar: Learning from Financial Disasters

Scott has experienced dramatic financial swings throughout his career. After selling his first company for $33 million, he made a critical mistake: "I was that guy who then borrowed money against his stock to buy more red envelope, because I thought, I'm so good that if I throw myself 110% at anything, I'm bigger than the market."

This hubris led to multiple financial disasters: "When the Dot bomb hit in 2000, I went from being worth probably 30 or 40 million on paper to negative net worth. And then I clawed my way back to 2007, and then '08 came, probably back to 10 or 20 million in net worth. Then '08 came and I went back to zero."

The painful lesson became his mantra: "Diversification is your Kevlar." Today, he follows a strict rule: "I don't invest more than 3% of my net worth in any one thing." This approach creates resilience: "I can take a bullet to the chest, I can have a $5 million investment go to zero. But because now I'm in a very privileged position, it doesn't represent more than 3 or 4% of my net worth. It hurts, but it's not fatal."

Scott emphasizes that this approach isn't just about financial health but mental wellbeing: "In 2000 when the Dot bomb implosion happened and the great financial recession in 2008, it was exceptionally stressful and hard on me mentally, emotionally." The pain of loss far outweighs the joy of gain: "Going from whatever it was, 15 or 20 million to 0 or -3 was a lot more painful than the joy of going 10 to 100, which I've also done."

When Enough is Enough: Spending, Giving, and Wealth Hoarding

Scott is refreshingly transparent about his wealth philosophy: "I think there's a virus in America and that's hoarding money. I don't think there's any reason, once you have your number, to not spend it or give it away."

His personal "number" evolved over time: "If you'd ask me when I got out of college, I probably couldn't have imagined having $1 million. Then when I had my first kid, I thought, I need to get to 10 million... then I thought, okay, it's 100 million. But once I got there, I thought, that's it, I want off this treadmill."

Now, Scott has a clear approach to wealth: spend generously, give generously. "I'm a yes to everything," he explains. "Anyone who calls me and says, let's go to Stagecoach in Palm Springs, a bunch of us are meeting there. I'm a yes with the understanding I can back out, but my attitude is I'm going to be dead soon. There's amazing things the world offers."

On philanthropy, he's equally enthusiastic: "I'm giving away about 20 million bucks in the last five, six years. Anything above my number now I either spend... or I give away. And I don't do it because I'm a good person. I do it because it feels fucking awesome."

Scott reserves particular criticism for extreme wealth accumulation: "I don't understand how in America we've developed the zeitgeist of people aggregate one, five, $100 billion. That makes absolutely no sense to me. Hoarding is a virus in America."

Other Key Quotes

"Not talking about money. It's kind of a zeitgeist or a cultural norm that the rich use to keep the poor down."

"The vast majority of people are only comfortable signing the backs of checks, not the front of checks."

"The difference between making a good living and creating real wealth is not how much you make, it's how much you save."

"Life is three buckets. It's things you have to do... things you want to do... and then there's things you should do. I have eliminated the should bucket."

"If you want to be really successful, you have to collect allies along the way. You have to be put in a room of opportunities, even when you're physically not in that room."

"To not acknowledge just how ridiculously fucking lucky I am would be an insult to the universe."

Links You Might Like

- The Algebra of Wealth - Scott Galloway's latest book

- Scott Galloway's Website

- Prof G Podcast

Full Transcript

[00:00:05] Scott Galloway: I can tell you, going from whatever it was, 15 or 20 million to 0 or -3 was a lot more painful than the joy of going 10 to 100, which I've also done.

[00:00:14] Sam Parr: My friend Scott Galloway is an endless well of advice, and the reason being is he started many companies. He sold a few for hundreds of millions of dollars. He's made fortunes, he's lost fortunes. He's been divorced, he's been happily married. He's got all types of crazy life stories. And because of this, the advice that he gives me whenever I ask him for advice, he's never repeating things that he's heard for others or speculating. He gives advice because he's lived through it all. In this episode of Money Wise, he's going to share all the wisdom that he's picked up. Scott Galloway is a popular guy. He has his own podcast, and he's a guest on a lot of other podcasts. And on this episode of Money Wise, my goal was to ask him questions and to dig deep on things that he has rarely talked about publicly. Frankly, I think a lot of the questions that we talked about maybe made him a little bit uncomfortable at times.

[00:01:01] Scott Galloway: You know, I hear my words coming out of my mouth and I'm like, I feel like such a fucking douchebag. I like, I want to take a shower after talking about my wealth.

[00:01:10] Sam Parr: But don't worry, Scott is completely on board with the purpose of this podcast.

[00:01:14] Scott Galloway: Not talking about money. It's kind of a zeitgeist or a cultural norm that the rich use to keep the poor down.

[00:01:20] Sam Parr: Along with the classic here's what you should do type of tips, we're also going to get more raw and talk about the honest, lasting impacts of embracing this lifestyle.

[00:01:29] Scott Galloway: Young people talk about wanting balance in their lives and it's like, okay, well then you don't want to be rich.

[00:01:33] Sam Parr: And we're also going to press him on his thoughts of when is enough, enough.

[00:01:37] Scott Galloway: And I don't understand how in America we've developed the zeitgeist of people aggregate one, five, $100 billion. That makes absolutely no sense to me. Hoarding is a virus in America.

[00:01:55] Sam Parr: I'm Sam Parr, and this is money wise. Scroll through Instagram for just 30s and you're gonna see tons of junk teaching you how to get rich, but none that teach you how to handle life after you've made a little bit of money. I'm one of the founders of a company called Hampton. We're a network of CEOs and business owners, and our members range from a small startup with a couple million in revenue and maybe ten employees all the way up to publicly traded companies with hundreds of millions of in revenue and thousands of employees. And so, because I'm a member of Hampton, I'm able to see all these private conversations, these conversations that never happen in public. Oftentimes they're related to money, whether that's making a lot of money or losing a lot of money. And it always intrigues me and frankly, helps me to see these private conversations. And so I thought, let's make a podcast about it and hence money wise. So with this podcast, money wise, we provide advice by speaking to people who have made a lot of money and they're radically transparent about all of their numbers, meaning their monthly expenses, their portfolios, and also, more importantly, all the personal issues and problems that come with being successful and how they're solving those problems. And of course, if you're a CEO or owner of a startup, you guys got to check it out. It's called Join Hampton. That's my company. You'll be part of a group with eight people who have similar size and types of businesses and lifestyles as you, and you'll be able to meet with them monthly to have conversations sort of like this podcast as well, access to hundreds of events that we host throughout the year and thousands of other members. So check it out. It's Join joint Hampton. Com. He's the host of multiple podcasts. He's a traveling speaker. He writes books, he's investing, he's doing all types of crazy shit, and he's made a ton of money along the way. The guy really just does not stop. But my question for Scott is where did it all start?

[00:03:36] Scott Galloway: I affectionately say we were part of the upper lower middle class and that is my mom was a secretary. I don't think we ever had a household income above 40 or 50 grand. We lived in Los Angeles. I went to public schools. It was stressful at the time because I remember from a very young age when my mom and dad split up, the money was always an issue. And I do think that people who grew up in economically secure households do have a difficult time empathizing with people who don't grow up with financial security, because it's as if a kind of a ghost is following you. And in my case, me and my mom around kind of whispering in our ears all the time, you're not worthy. You've kind of failed. And there's this, these weird moments. You notice. I remember being in Little League and we'd win. And whenever we'd win, all the families would go to dairy Queen or something like that. And if they were going to a restaurant, my mom would kind of sequester me into the car and we'd go home and I sort of figured out it's because she didn't we couldn't afford to go out to a restaurant during the middle of the week. There's just little things. I used to be very stressed. I wrote about how stressful it was when I lost my jacket. I'm one of those people that loses everything, and jackets cost $33. Even back in the in the 70s and 80s. And I think one of the unfortunate things about America is that the great thing about America is it is true. Anyone can be anything but that also connotes a certain zeitgeist that if you don't make it out, it's your fault and that anyone can get out. It's just a decision. Oh, I want out of this economically unfortunate situation so I can make the decision and do what's required and get out. And I don't think people realize how much. It just kind of destroys your confidence.

[00:05:15] Sam Parr: So money was already a constant issue in his early life, but then things took a turn for the worse.

[00:05:21] Scott Galloway: My mom got sick, and that's where a lack of economic security really kicked in, because it was just me and her. So as the man of the House, quote unquote, it was upsetting and even humiliating not to be able to take care of her. She was discharged after surgery from the hospital early. And I remember coming home to a very, very ugly situation and calling around to get a nurse to come to our house, and nurses were $30 an hour, which there was no way we had that kind of money. But I remember thinking very early, you know, there's good and there's bad. It was very motivating for me. I've always had an appreciation for money. I really enjoy it now. I think I probably enjoy it more than most people because I didn't have it at one point. But it also was very, very stressful. But it created no doubt about it. At a very early age, I thought, no one makes a decision to be wealthy, but I decided I was going to try very, very hard and that I was willing to make really significant sacrifices to try and get there because I wanted out. I didn't want to go back to that place of financial insecurity.

[00:06:24] Sam Parr: So Scott committed to working hard. He does credit his work ethic and natural abilities for part of his success. However, he does reserve credit for those who gave underprivileged kids opportunities in the first place.

[00:06:42] Scott Galloway: I like to think that I'm talented. I know I'm talented, maybe even the top 1%, but being in the top 1% globally puts you in a room that has the population of Germany, that has 75 million people in it, and my life is much better on almost every level than the top 75 million people in the world. And it's easy to credit your grit and your character for your success and blame the markets for your failures. But I don't have any such delusion. I believe I'm here with you because of the generosity of California taxpayers and the vision of the regents of the University of California who loved unremarkable kids. And I think that's part of the problem with America right now is it's become sort of The Hunger Games, where higher education and the economy have decided, well, let's find the freakishly remarkable or the children of rich kids and create a super class of billionaires. And the bottom 90% kind of die a slow death. I think a lot about what was great in America in the 80s, as typified by the University of California, changed my life. I got a job at Morgan Stanley, which I wouldn't have gotten had I not if I didn't have the credential from UCLA. And then I got into Berkeley graduate school with a 2.27 undergraduate GPA, and if I hadn't worked at Morgan Stanley for two years and done fairly well there, I wouldn't have got into graduate school. And then out of graduate school, I was able to raise tens and then hundreds of millions of dollars for startups. Even some work, some didn't. But I was given the opportunity to raise money and then fail and start over because of my credentials and because of my contacts and because of the education I got there. The big hand of government and public education, kind of, I don't want to say, saved my ass. I think I could have probably made a lot of money selling copiers or cars. I'm a talented person. I'm aggressive, but I wouldn't have recognized nearly the success. I've been able to register economically. And it's because of big government.

[00:08:28] Sam Parr: Good will, hard work, dedication, help from others, according to Scott, accounts for most of his success. But there's another huge factor to consider, and it's likely the most difficult one to commit to sacrifice.

[00:08:43] Scott Galloway: Young people talk about wanting balance in their lives and it's like, okay, well then you don't want to be rich. I've had two periods in my life, one where I had a lot of balance, good relationships, great shape, hobbies, and periods where I had no balance. Was working all the fucking time. Was incredibly anxious. My relationships were suffering. I was losing money. My net worth was going down on the former. My net worth was increasing. In the latter. It is very difficult to maintain balance if you want to achieve a certain level of success. I'm not suggesting you can't have it at some point. I have a lot of balance now because I had very little in my 20s and 30s, but it requires a sober conversation. If you want to move to Saint Louis and coach Little League and work 40 hours a week, have at it, and have a decent home for not a crazy amount of money. And by the way, there's nothing wrong with that life. But when I talk to young people and I ask them how much money they expect to make, most say in the top 10%, if not the top 1%, I'm like, well, if you expect that, then just stop using the word balance because it's a competitive economy. There are a lot of people willing to work very hard, and I often joke that my success and my 20s and 30s cost me my hair and my first marriage, and that it was worth it. I have a lot of balance now because I didn't have much when I was young, so you can have it all. You just can't have it all at once.

[00:09:58] Sam Parr: That's a hard truth. And accepting it is the first piece of advice from Scott. How successful you get oftentimes depends on how much you're willing to sacrifice, and only you can decide when that sacrifice has stopped being worth the reward. The good news is, is that if it has worked out for you, you can tap out, take your winnings, and live a good life. If that's something you're considering, I'd recommend checking out our episode on retiring early after this one. But then, of course, there's the bad kind of sacrificing, and we'll get to that right after this ad break. So after making a bunch of money, it can get easy to get into your head that the reason it happened is because you are awesome. And don't get me wrong, it's great to have confidence, but there is always luck involved and there's no guarantee that you're going to get lucky again. Luckily for Scott, he managed to succeed, although he made some poor decisions that could have jeopardized everything that he worked for.

[00:10:50] Scott Galloway: I always made a lot of money. I was always pretty hard working, pretty talented in California, coming of age in the internet era. But one of the mistakes I made was I always went all in on my company. So in 1999, I started a brand strategy firm called profit. And then when I was 26, I started a strategy firm. It grew to a couple of hundred people. I sold it for $33 million, so had some money, had to split it with my ex-wife, and also doubled down on a couple of internet companies that I started in the basement of profit, a pet supplies company, a gift company called Red envelope.

[00:11:22] Sam Parr: Well, how much did you make from profit?

[00:11:24] Scott Galloway: Well, I mean, I owned about 20 or 30% of the company. And then after splitting it with my ex and then after taxes, I had 2 or 3 million bucks, which felt like a lot of money at the time, but I dumped all 32. Yeah, early 30s. So I thought that was a lot of money. And it was at the time.

[00:11:40] Sam Parr: It is a lot of money. Yeah.

[00:11:41] Scott Galloway: But I immediately doubled down and thought, I'm awesome, I'm good at this. So I put it all into red envelope, and I was that guy who then borrowed money against his stock to buy more red envelope, because I thought, I'm so good that if I throw myself 110% at anything, I'm bigger than the market and will, it'll do really well. And I'd read all these stories about entrepreneurs going to Vegas to make payroll at Fedex or what have you. There's just the media and the kind of the mythology of entrepreneurship is all about this. And then when couple times when the Dot bomb hit in 2000, I went from being worth probably 30 or 40 million on paper to negative net worth. And then I clawed my way back to 2007, and then oh eight came probably back to 10 or 20 million in net worth. Then zero eight came and I went back to zero. And the lesson here is that one of the keys to creating and holding wealth is diversification. I have about 30 investments right now. If you were to ask me a week ago which one I was most excited about, it was a company in the health care space that's using AI and a bunch of stuff. It shut down last week. It's a zero. I invested 5 million in it, which is a lot of money for me.

[00:12:51] Sam Parr: But of your own money? 5 million of your own money?

[00:12:53] Scott Galloway: 5 million of my own money.

[00:12:54] Sam Parr: Wow.

[00:12:55] Scott Galloway: But here's the thing. I don't invest more than 3% of my net worth in any one thing. So when I found out last week that it went to zero, I was like, okay, that's bad. It ruined an hour for me. And then literally two hours later, I wasn't thinking about it because diversification is your Kevlar. So once you get to a certain point of net worth, you need to start diversifying like crazy. And most young people and people who've had some success every ounce in their body is telling them not to diversify because they want to go all in on something. And I got hit so hard a couple times because I wasn't mature enough and didn't understand the power of diversification. Diversification is your Kevlar. I can take a bullet to the chest, I can have a $5 million investment go to zero. But because now I'm in a very privileged position, it doesn't represent more than 3 or 4% of my net worth. It hurts, but it's not fatal. I get up and I'm fine. Whereas when I was a younger man, I thought, well, you need to go all in. You need to be totally committed, go all in in terms of your time and your focus, but in terms of your assets, as soon as you have the opportunity to diversify, you should and hope that you're wrong. Hope the one asset you're diversifying from goes up ten fold. You're still going to be fine. But here's the thing also that people don't talk about is in addition to your financial health, you want to think about your mental health. And that is in 2000 when the Dot bomb implosion happened in the great financial recession in 2008, it was exceptionally stressful and hard on me mentally, emotionally, and what Kahneman showed us. How old were you.

[00:14:23] Sam Parr: When that happened and how old were you in? 30 in 2008.

[00:14:26] Scott Galloway: 35 and 43. And the problem was that was about the same time my son had the poor judgment to come marching out of my girlfriend. So as soon as I became a father, I was broke. And I had this.

[00:14:36] Sam Parr: Negative net worth.

[00:14:37] Scott Galloway: Right? Negative net worth I went from being worth, I think, about 20 million to -3 million in about, I don't know, 11 weeks or in late or early oh eight. And I remember feeling this sense of failure that it's no longer about me. And my first feeling when I saw my son was nausea because I thought I'd failed him. I was already failing as a father. I was so stupid, so self-absorbed, so egotistical that I thought I was bigger than the market, that I could survive anything. And then the great financial recession came and taught me something different. So what I'm trying to tell people now is if you're fortunate enough to aggregate any amount of wealth, you immediately want to start diversifying. Because back to Kahneman, the upside is not worth the downside. And it's loss aversion theory. In other words, you should give up some potential upside through concentration. And the richest people in the world were highly concentrated. That is not your role model. Who you want to be is someone who has enough money to live a great life and be free of the stress, such that you can focus on your relationships. And the way you get there was with with focus so you can make good money investing. Always be in the market. No one can predict the market, and the market has been up and to the right over the medium and long term, and also diversify such that when shit gets real and the market goes down and you do have recessions. And recessions used to happen every seven years, they haven't happened in 16 years. But when they do happen, you lose some sleep, but not a lot. Because the downside, I can tell you, going from whatever it was, 15 or 20 million to 0 or -3 was a lot more painful than the upside of going 10 to 100, which I've also done.

[00:16:13] Sam Parr: Personally, when I see the market go down by something like 5%, I do sweat a little. And to be fair, as you've heard me say on the show a ton of times, my investments are very safe. I'm an index bonds type of guy, but when you have a lot of money, a little movement in either direction, it can feel huge, for better or for worse. But I'll tell you what. Going from 20 million to a negative net worth. That is insane. I would freak out. Coming back from that is not really just finding the next business idea and getting to work. I mean, that's like almost traumatic. You almost got to go to therapy for a minute or read a book or something and then get to work. But yeah, that's a challenging thing.

[00:16:51] Scott Galloway: Unfortunately, I was blessed with a total lack of self awareness from 0 to 40. I had two little anxiety. I almost got kicked out of UCLA 3 or 4 times for different reasons. I almost got fired from Morgan Stanley. I just was never that anxious about anything. And from 40 to 50, I think I had exactly the right amount of anxiety. And now I have too much. I'm worried all the fucking time. I'd like to think one of my superpowers is I've always been able to kind of mourn and move on. So yeah, I felt awful. It was mentally very taxing, especially when I had a kid, but I was able to I don't want to say disassociate, but recognize that a lot of your success is not your fault. When you get promoted, when you have an investment, triple, when you're in a good relationship, realize that a lot of it is is you, but some of it is not your fault, and you should be humble and you should bring in your horns and be more risk averse, because you're never more prone to a big mistake than after a big win, because you start thinking it's you and that you can control the outcome of things. And in addition, when things go really poorly, when you get laid off, when you lose a bunch of money in investment, when someone you care a great deal about in a romantic relationship doesn't reciprocate, you got to figure out the people you hang around, and you got to just look in the mirror and figure out a way to say, I am the answer to a firm's problems.

[00:18:03] Scott Galloway: I can make other people a lot of money. I'm a very talented entrepreneur. If that's what you do. I can make someone very happy, because what I see is that a lot of people hit their first kind of failure. They have a business fail. They have a relationship, not work. Someone in their life close to them. One of their parents dies and they're stuck for years and sometimes never recover. I have several close friends who are hugely successful, never knew anything but success, and then had a failure. Maybe had a hedge fund, not work, maybe had a business go out of business and they kind of go sideways for 5 or 10 years because they just the world doesn't make sense to them. They're like, wait, I went to a great school. I was successful until the age of 40. I made a ton of money. The line was supposed to be keep going up into the right. So I've had enough failure in my life that I've been able to recover. And secret to my success is rejection. I said this on your other pod. I ran for sophomore, junior and senior class president in high school, and I lost all three times. And based on my track record, I decided to run for student body president, where I went on to wait for it lose. But I've always said to kids, if you want to score above your weight class professionally or personally, you've got to be able to take uncomfortable risk and to endure rejection.

[00:19:19] Sam Parr: The reality of life is that there are highs and there are lows, and no matter how safe you play it, the lows, they definitely will come. But that's not to say you can't tweak the odds in your favor. We just talked about overcoming your ego and not thinking you're going to be better than the market. But there's another trap that a lot of younger people run into when they just start making a little bit of money. And that's another thing Scott has personal experience with.

[00:19:41] Scott Galloway: Really what I was focused on was just, how do I be awesome and make a shit ton of money? I didn't think that strategically. I didn't realize that, well, maybe rather than blowing my first bonus check from Morgan Stanley, I got a $28,000 bonus when I was 23 at Morgan Stanley. And so I immediately went out and bought a $35,000 BMW and hung swim goggles from the rearview mirror such that I could signal my worth as a mate to strange women.

[00:20:10] Scott Galloway: And I get it. That's what young people are supposed to do. But had I decided to buy a Hyundai or Kia for 12 grand and invested that $23,000, now I would have something like 1.8 or $2.3 million just in an index fund. You just don't think that way. When you're young, you don't understand the power of compounding. You don't understand how important it is that the difference between making a good living and creating real wealth is not how much you make, it's how much you save. It's the ability to develop a savings muscle where you spend less than you make, and you start deploying an army of capital. And the earlier you can do that, if you start early, it's just shocking how little money can develop into a lot of money. And most people do not understand this because one of the flaws in our species is that for 99% of our time on this planet, we haven't lived past 35. So we do not believe we're going to live past 35. We also don't believe how fast it's going to go. You have a couple of things fighting you when you're young. One, you're in your mating years and especially as a man, the way you peacock, the way you demonstrate your worth as a mate, is you show an ability to make money by spending it.

[00:21:20] Scott Galloway: I get all of this, but if you have the ability to find a partner or have the discipline yourself to fight that urge and get aligned with a partner and start saving money from an early age, you don't need to sell your company like Sam or Scott, my closest friend who used to come pick me up in the fraternity who got a job at Great Western Financial. He used to work from four in the morning till noon. He was making not a lot of money. I remember him saying to me, I got to find 2000 bucks to invest in my IRA Roth. And I'm like, if saving $2,000 at this age means anything, when I'm older, I want you to shoot me. And that's what I thought. I thought, I'm such a fucking baller. At some point I'll make a shit ton of money. This is a guy who who has never made nearly the amount of money as me, and I think he's worth well over $10 million, because at an early age, he had a lot more maturity than me.

[00:22:10] Sam Parr: You don't always have to work endlessly and wait for your massive exit. If you have made money from an exit already, that is awesome. But while you can't guarantee another life changing amount of money is going to come your way, if you're smart with your money, you can't exactly guarantee it. But you can make the odds incredibly high that what you have will be enough to last. But I want to get back to this ego thing. Scott was saying that you need to humble yourself and realize that the market is more likely a better thing to bet on than. Yourself. However, being an entrepreneur is literally betting on yourself. For most people coming from regular lives, you kind of do have to have a few screws loose or some false sense of confidence to put the amount of time and money needed into building a successful company. And I pressed him on this.

[00:22:55] Scott Galloway: You're the classic entrepreneur. You're too stupid to know you're going to fail. You're willing to sell. You're willing to fail publicly. You're willing to have your friends see you selling fucking hot dogs on the street, and now you're living large. So if you want to be an entrepreneur, if you really want to, like, make a shit ton of money more than your friends, if you want to have a higher character mate that people understand, don't understand why this person would be with you. There's one thing I call it the spoon, and that is you need to get out of big spoon and be willing to eat shit. The most overcompensated people in a company are the salespeople, and they either played with the wrong toys or the right toys, and they're willing to call people who don't want to hear from them. Again, when you are an entrepreneur, you've got to call people and ask for money. You've got to call people who don't want to work with you and convince them to come to work with you. You got to call clients and pitch them. You got to go out with people and take them to dinner and play golf with them that you have no interest in spending any time with, and pretend that you're good friends, or at least try really hard to establish a good friendship. And here's the thing 99% of people are not willing to do that. They aren't willing to risk public humiliation. Some people just would never call someone who says, no, I'm not interested, and then call them back a week later and say, hey, I'm checking in again. Those people punch way above their weight class. People don't understand. The majority of those people are never willing to do with the story I tell is in terms of risk aggressiveness.

[00:24:18] Scott Galloway: We are about to sell L2, my last company for 160 million. I was very transparent in all hands movies. I'm like, this is my plan. I'm not trying to save the whales or build a better world. I want to build this company with these features. Dynamics. Sell it for an irrational multiple. This is where we are. This is how much I think we can. This is the range of valuation in our company. I'm thinking probably of selling it in the next 2 to 5 years. I was never that entrepreneur. That was like, well, if we just focus on building something great, it'll all fall into place. Or I never pretended that I didn't care about money. I was always transparent with the team. We were on fire at L2 and the employees knew it. I gave options to everyone in the company if they exercised their options a year before the company is sold and they write a small check 3000 10,000 for some who had a lot of options, 70, 80, 150,000, Then if we got sold a year later or more, they would get much better tax treatment, right? They would get charged tax 22% or 23 instead of 37. I explain this all to them, all to them and a bunch of people on my board without me explaining them who I gave options to all exercised their options because they saw the financials, but so did the employees. You know how many employees exercise their options and cut a check to the company? Zero. The vast majority of people are only comfortable signing the backs of checks, not the front of checks. When you started your hot dog stand, whatever it cost to start it up, most people aren't willing to do that.

[00:25:43] Sam Parr: It was $900. It was $900. And that's all I had.

[00:25:46] Scott Galloway: And then a bunch of your time not getting paid and risk of public failure and being outside in the sun with a girl you met at a bar a few days ago sees you selling hot dogs on the street. Here's the key to success is the willingness to endure rejection.

[00:26:08] Sam Parr: A few minutes ago, Scott talked about how he just recently lost $5 million on an investment. But he's fine. As you move your way up and accumulate more. If you stay smart, the stakes get lower. Losing 5 or $10 million, shockingly, may not feel like that big of a deal. The game gets easier and easier and potentially too easy. But then some people don't stop. And Scott says that is a problem.

[00:26:32] Scott Galloway: I think there's a virus in America and that's hoarding money. I don't think there's any reason, once you have your number, to not spend it or give it away.

[00:26:40] Sam Parr: And what was your number?

[00:26:42] Scott Galloway: My number was 100 million. And by the way, my number kept changing. If you'd ask me when I got out of college, I probably couldn't have imagined having $1 million. Then when I had my first kid, I thought, I need to get to 10 million. And then when I started acquiring homes and more kids and wanting to live in New York and London, and then I thought, okay, it's 100 million. But once I got there, I thought, that's it, I want off this treadmill.

[00:27:02] Sam Parr: Well, why that number? Why, why 100? It's 2024. So $100 million that if you do 4%, that's $4 million a year in spending. Why 100? Is there anything that 100 can get you that 20 or 50 can't or ten. Yeah.

[00:27:14] Scott Galloway: The difference is you can get more money away and you can have a plane. I mean, just being very open and honest about it. But 3 or 4 million is exactly what I thought. If I have that amount of money, I can do absolutely everything I want. I can spend a ton of money on experiences, spend a ton of money on my family and my friends, and still have some money to give away. But where I was headed is I don't understand people who I thought at one point, well, wouldn't it be nice to be a billionaire? Maybe I should take some more risk? And I thought, why the fuck do I want to be a billionaire? Because what again, what Kahneman shows is once you get to financial security, that incremental increase in income or wealth isn't going to make any happier. As a matter of fact, some of the people I know who are very wealthy, I'm not sure that it helps them. And also, I think it might even strip their kids a little bit. And also giving away money feels really awesome. I'm not trying to virtue signal. It's something I love doing.

[00:27:59] Scott Galloway: It makes me feel masculine. It makes me feel like a good citizen. I love investing or giving money to things I'm passionate about. I'm giving away. I think about 20 million bucks in the last five six years. Anything above my number now I either spend. I think there's some nobility to spending, put it back into the economy, have a ton of fun. You're going to be dead soon. I'm a yes to everything. Anyone who calls me and says, let's go to Stagecoach in Palm Springs, a bunch of us are meeting there. I'm a yes with the understanding I can back out, but my attitude is I'm going to be dead soon. There's amazing things the world offers. I'm not going to let money get in the way of anything and anything above a certain amount. Every year that I need, I give away. And I don't do it because I'm a good person. I do it because it feels fucking awesome. And I don't understand how in America we've developed the zeitgeist of people aggregate one, five, $100 billion. That makes absolutely no sense to me. Hoarding is a virus in America.

[00:28:54] Sam Parr: Yeah, but I'm gonna. I'll play devil's advocate. I'm gonna say 100 million is the same thing. There's no difference between you saying that about a billion and someone saying that about a 100 million, and there's no difference than someone who says that about 50 and ten. I mean, you know what I mean? Like, you could make arguments for a variety of numbers.

[00:29:10] Scott Galloway: The retort to that, I think that's a fair the retort I can make to that is I can live and no one's can feel sorry for me. I can spend 3 or $400,000 a month more easily than you might think. I live a very nice life, but it's not like I'm, I don't know, I'm on yachts and everything you can. It's amazing if you live in New York and London, how much money you can spend.

[00:29:30] Sam Parr: So let's talk about that. How much does Scott Galloway spend and what is he spending it on? That's in a minute. Stick around. All right. The burning question how does Scott Galloway spend his money?

[00:29:42] Scott Galloway: So funny. It's like I'm very self conscious about money. I was self conscious when I didn't have enough money. Now I'm self conscious now that I have a decent amount of money. I spend about $100,000 a month on mortgages and real estate. I own four very nice homes. I spend probably another 50 to 100 on living expenses. I spend probably another $100,000 a month on travel. I would say that's probably our biggest expense. We do incredible things with our family, and I have a plane where I spend probably 100 to $125,000 a month.

[00:30:12] Sam Parr: You own or you charter.

[00:30:14] Scott Galloway: I used to own and I sold my plane and I do something much smarter now I do fractional less headache.

[00:30:19] Sam Parr: Why did you own that? Seems like a horrible idea.

[00:30:22] Scott Galloway: It is a horrible idea. But it's like so is owning a boat. But you still want to own one. I've always been. And my dad used to take me to Orange County Airport when I was a kid. Before there was even security. It was like a restaurant on a runway.

[00:30:34] Sam Parr: It really all started.

[00:30:41] Scott Galloway: And now it's called John Wayne Airport. And he put his hands over my ears and we'd watch planes take off. And I could I could tell, oh, that's a 727, that's a 737 Air California and PSA. And it was a nice moment for us. And I got very into aviation. I can still look up in the sky and tell you what kind of plane it is. And I've always had an obsession with aviation. For me, owning a plane is something I wanted since I was probably 25, so getting to buy a plane for me was sort of just, I don't know, a personal I'm sure there's something crazy you've bought because you just always wanted that thing. For me, it was a plane, did it for three years, realized what a hassle it is, hiring and firing pilots and healthcare and maintenance. And I just went fractional, which is, you know, I hear my words coming out of my mouth. I'm like, I feel like such a fucking douchebag. I like, I want to take a shower after talking about my wealth. I'm trying to be open about this is.

[00:31:30] Sam Parr: This is the point of the podcast is, I think, to make.

[00:31:33] Scott Galloway: Me feel awful and no come across as indulgent douchebag.

[00:31:36] Sam Parr: No, it's not because I think that there's a lot of people who discuss this. For people who make $150,000 a year, there's like a million different Dave Ramsey's of the world. But when I sold my company the four years leading up to sell my company, I paid myself 20 grand, 20 grand, 80 grand, $500,000. And then I sold the year four and a half, and I made tens of millions, and I was overwhelmed. It's a good problem. But, you know, when I say to that, when people say that's a good problem, it's still a problem. And I know it's nonsense. I felt like, look, it's a good problem in that rent was paid for and I wasn't ever going to go hungry again. But I still felt uncomfortable about many things. And I think that to deny that, like, we can't talk about something just to help the top 0.1%, that's That's silly. We could help all types of people.

[00:32:22] Scott Galloway: Okay, first off, I 100% agree with you in the sense that there's a great line in The Godfather where this guy's asking for the hand of the Godfather's sister or daughter or something, and he talks about his success and he says, you know, I don't mean to brag. And he's like, no, it's important. He's like, not talking about money. It's kind of a zeitgeist or a cultural norm that the rich use to keep the poor down. And one of the reasons I'm open about my money is that I think people should talk about money. I think they should talk about how much they make, how they're spending it, how they're saving it, their tax strategies. If you want to be amazing at tennis, you got to think about it and talk about it. You think Roger Federer never talks about tennis? He talks about all the fucking time. If you want to be good at money, you have to get a certain level of financial literacy. And then you have to say to a guy like Sam, Sam, what do you investing in? Or why do you invest in? Or who do you use for tax planning? Or what are the tax advantages of living in this state? Talk to your friends about money. I try to be very transparent around, you know, my ups and downs economically, what I have learned, the mistakes I've made. I think I'm pretty honest, but I'm also honest about my wealth and what I do with it and why I like it, but But where I am in my life is I've hit my number. I'm done. I'm either going to spend it on friends and family and just squeeze so much juice out of this lemon called life, or I'm going to give it away, but I don't need any more.

[00:33:45] Sam Parr: Okay, I had to stop him there. Scott says that he's done, but I've see Scott and I know he's an incredibly hard working person. And there's this thing he says a lot. He says it in his new book, The Algebra of Wealth. He says, if you want to get rich, follow your talent, not your passion. But one has to assume that that's only temporary advice. One of the reasons we want money is to give freedom to pursue the things that we're passionate about, and to do things that bring us joy. Scott kind of lives that way. He worked hard in businesses when he was young, and now he spends the majority of his time on things he loves. Once you get to that stage where you hit your number, you have to start on building the workhorse muscle. Otherwise what's the point?

[00:34:30] Scott Galloway: There are some days where I think, okay, why am I still here working this hard? But 90% of the time. I went to Scotland yesterday on a whim. And the great thing about podcasting and writing and speaking, you know, except for the speaking where you do it live, I can do everything remote. I love the topics I get to write about. I get to talk about being a father. I work with a small group of 14 people. I don't have outside investors. I get to pretty much do whatever I want, whenever I want. This is one of the things that wealth has provided me. Life is three buckets. It's things you have to do. You know, Sam, if our biggest investor is in town, when we had our business and they want to have dinner, you have to meet with them, right? There's still things we have to do. There's things you want to do. Right? I'm going to Cannes in a couple of weeks for a conference. I'll speak there, but I'll take my family. We'll stay at the hotel du cap. It's amazing. South of France. I want to do that. And then there's things you should do. Oh, a colleague's daughter is getting married. Oh, there's a networking event with a lot of powerful people. You should go. I have eliminated the should bucket, and it's actually a point of tension with my spouse. I'm like, no, that's a should thing. I'm not going. I don't want to go. I don't have to go. You think we should go? I don't do should anymore. That is a real point of privilege, but I don't at this point. I'm just pretty much doing what I have to do or I want to do. And I work hard because I like to work. You know, I'm really passionate about the topics I'm talking about. Sam, I talk a lot about the struggles facing young people, specifically young men. I love doing podcasting. I love talking about the economy and things that are going well and not going well. So I can't imagine having more fun than I'm having right now. This is pretty much 90% want.

[00:36:17] Sam Parr: If you remember on this episode that we did with this guy named Jeff, he talked about having to literally cut himself off from working and earning more money. He said the act of it was like an addiction. Now, I know it sounds crazy, but actually forcing yourself to slow down and figure out how to enjoy your life can be difficult, especially after years of grinding and conditioning yourself to building stuff. Sounds like Scott has got a pretty good handle on it though. Now there's one last thing that Scott and I talked about, and it's something I'm kind of obsessed with recently. It's the idea of luck, which is something we mentioned briefly earlier in this episode. No matter how hard you work, how much strategy, how much planning you have and all these things, luck, in my opinion, is always going to be one of, if not the biggest factor in someone's success. I know that's controversial, but that's my opinion.

[00:37:04] Scott Galloway: The most rewarding thing in my life right now is that I have a partner who I've built this wealth with, who does an amazing job as a mom, and we just love spending time together. And that's because I decided to go to the Raleigh Hotel on a Sunday afternoon, and had the gumption to approach a woman and say hi in the middle of the day at a hotel. If I'd been born in 1920s Germany is a is a male, I would have probably ended up dead on a Russian field somewhere. If I had gone to the University of Texas at Austin, where I enrolled, I probably would have ended up in energy, which hasn't performed nearly as well as tech where I ended up because I went to Berkeley, I didn't have some passion for tech. It's just coming out of Berkeley. In the 90s, you ended up in tech, so I struck gold accidentally a bunch of times. You're in a certain range because of when and where you're born. That's the key. My parents were never going to recognize or register the success I've registered. If I'd been born in Europe, I couldn't have been as successful as I am because they don't tolerate failure and I've had a lot of failure. If I'd been born in China, I might have ended up in prison because I'm outspoken and kind of immature and reckless with my words sometimes, and that doesn't go over well there.

[00:38:08] Scott Galloway: So being born in 60s California is a white heterosexual male was hitting the lottery. My roommate died of Aids. Like, how fucking unlucky is that? It wasn't his choice to be gay. It wasn't my choice to be straight. I end up here talking to you, living in Marylebone. He died at 33 of full blown Aids. So to not acknowledge just how ridiculously fucking lucky I am would be an insult to the universe. Now, what I will say is that's not in your control, but there are some things in your control. So you want to focus on the things that are in your control. You want to build a lot of social goodwill in terms of character, helping people out, investing in relationships, working really hard. I mean really hard. Not being afraid of risk, not being afraid of public failure. All of these things help me score at the high end of my range. So luck plays a huge role, but I like to think that some of the character and drive in investments in other people and reverence for relationships would have meant that wherever I was in that weight class, I would have been at the top. And the thing that really bugs the shit out of me is some of the wealthiest people in America. Basically, tech bros conflate luck with talent.

[00:39:18] Sam Parr: What's an example?

[00:39:19] Scott Galloway: Peter Thiel, Jeff Bezos, Elon Musk, Chamath Palihapitiya?

[00:39:24] Sam Parr: I think a large amount of successful people are humble enough to admit that there's a luck component.

[00:39:30] Scott Galloway: I find there's a virus in the tech community of billionaires who make a lot of money in their 30s, who are under the impression it's all about them. And if you look up and down the geography of the United States, across the West Coast, there's multi-trillion dollar or multi $100 billion companies littered along the West Coast. And then you get to Canada and then you have to go all the way to Lululemon in Vancouver, and you get to San Diego, and you got to go all the way to Mercado Libre or Nubank in Brazil, or in Argentina to be born in the US or have access to immigration status to get into the United States is hitting the lottery and then to engage in and start shitposting America at every turn. And talking about how awful America is, is just obnoxious. And the people who are most patriotic to America are the people who've invested the most, and that is our veterans. And I find that some of these tech pros in their 30s who are all about them. I just find it obnoxious. I don't think they have. Again, there's another virus that infects young people in tech, and that is they conflate luck with talent. They don't register how fortunate they are. To your point, I think the majority of very wealthy people, I do not demonize rich people. The majority of very wealthy people are good people, and that's one of the reasons they're wealthy, is that if you want to be wealthy.

[00:40:43] Sam Parr: It's hard to kick ass without giving value. I think it's hard to have a long career by being an asshole. Some people pull it off though.

[00:40:49] Scott Galloway: If you want to be really successful, you have to collect allies along the way. You have to be put in a room of opportunities, even when you're physically not in that room. So if you want to be successful, start investing in relationships. Be kind. Be generous. Help other people out. You want allies. And there is a myth that wealthy people are not good people, that they're Monty Burns lighting cigars with $100 dollar bills. That's not true. The majority of wealthy people I meet distinctive what I'll call this virus in Silicon Valley of young tech bros who are billionaires are good people. They're high character people. Wealth is a full person project.

[00:41:26] Sam Parr: And here we come back to the core of this entire episode, keeping the ego in balance. As business owners or founders, I think we all sort of naturally have a bit of an inflated ego. It's part of what makes us successful. I think that in order to start something, you have to be confident in your abilities, at least confident enough that you're willing to risk money, risk time, risk looking stupid, and take risks that most people think are a little bit nutty and aren't common, or are things you probably shouldn't be doing. But that strength, in my opinion, I think that can ultimately become a weakness. And the reason being is I remember when I first started my career, I thought it was all up to me. I was responsible for 100% of my own outcome, but I've been fortunate that I've achieved a few things and my opinion actually has changed. I think that there's been so much weird lucky times in my life that it just had a massive outcome, and I probably worked as hard as many other people in my shoes. I was probably as skilled, sometimes a little bit less, sometimes a little bit more. But my outcome was awesome and it just things just happened out of pure luck. And I am okay admitting that. Now. Of course, I think that I will tell my children that I am where I am strictly because of hard work. In reality, I know that luck in my opinion, has been a massive factor. And so in my opinion, this is also a good way to not let the ego consume us. I think we should be humble. I think we should spend wisely. I think we should make time for friends and family. We should pursue happiness, not money, and never conflate the two.

Personally, I find being the CEO of a startup to be downright exhilarating. But, as I'm sure you well know, it can also be a bit lonely and stressful at times, too.

Because, let's be honest, if you're the kind of person with the guts to actually launch and run a startup, then you can bet everyone will always be asking you a thousand questions, expecting you to have all the right answers -- all the time.

And that's okay! Navigating this kind of pressure is the job.

But what about all the difficult questions that you have as you reach each new level of growth and success? For tax questions, you have an accountant. For legal, your attorney. And for tech. your dev team.

This is where Hampton comes in.

Hampton's a private and highly vetted network for high-growth founders and CEOs.